Features

Business

Research

IDENTIFYING THE PRIORITIES OF ORNAMENTAL HORTICULTURE GROWERS

January 18, 2008 By Greenhouse Canada

The research and analysis provided by the report will now be used by Flowers Canada Growers and the Canadian Nursery Landscape Association to help develop and implement risk transfer options.

A report produced for the Canadian Nursery Landscape Association (CNLA) and Flowers Canada Growers (FCG) clearly identifies and prioritizes risks facing growers in the ornamental horticulture industry.

A report produced for the Canadian Nursery Landscape Association (CNLA) and Flowers Canada Growers (FCG) clearly identifies and prioritizes risks facing growers in the ornamental horticulture industry.

Based on extensive grower consultation, the report’s conclusions and recommendations are the first step in a process designed to develop risk management options for growers. The research and analysis provided by the report will now be used by FCG and CNLA to help develop and implement risk transfer options such as a protection fund, an insurance policy, or other alternatives.

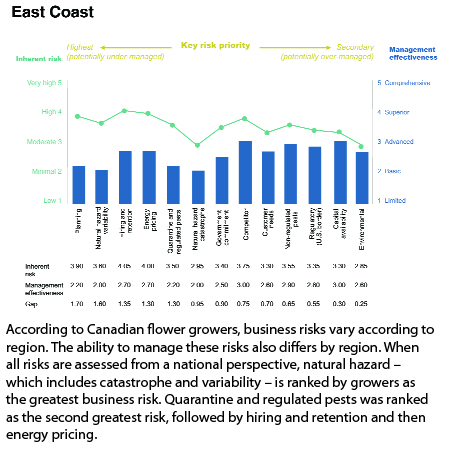

In the report, produced by consultants Mercer Oliver Wyman, nursery and floriculture growers as a group ranked natural hazard, which included catastrophe and variability, as the greatest business risk. Natural hazard risk relates to the inability to plan for and recover from a significant weather interruption.

Quarantine and regulated pests was ranked as the second greatest risk, followed by hiring and retention and then energy pricing.

“The real focus of the report is to generate information needed to help government and the insurance companies better understand both the nursery and floriculture greenhouse industry, and help develop effective business risk management products,” said CNLA growers’ manager Rita Weerdenburg.

FCG research director Jamie Aalbers added that prioritizing the risks is key to helping develop effective risk management tools. “When you talk to growers about business risk, you get different answers. But by consulting with growers across the country, we’ve been able to determine that weather-related risk is the one that we can do the most about for the most growers across the county. That’s the real value of the report.”

Mercer Oliver Wyman reviewed publicly available information about the key risks for the nursery and floriculture sectors before undertaking extensive consultation with growers, which included 10 grower focus groups across the country. Two focus groups were held in each region, one for nursery growers and one for floriculture growers. Participants discussed the drivers of each risk and voted on the impact and likelihood of each risk occurring, from an industry perspective, within a one-year time frame.

Aalbers and Weerdenburg said the strength of the report comes from the fact that it represents the views of producers across the country. “We now have input from growers that is necessary in helping government and the insurance industry understand the risks and how we prioritize them,” said Aalbers, who notes that the report also highlights the importance of regional perceptions of risk.

“The report does show that the risks in B.C. are very different from the Prairies, and other regions. I think that’s a key takeway from the report – the understanding that the priorities are going to differ from region to region,” said Weerdenburg.

Overall, 12 risks were evaluated by growers. The report provided summary recommendations for the top four risks.

• Natural hazard – catastrophe and variability. The report recommends analysis and development of an acceptable (by growers and insurance companies) long-term production insurance program through the private sector. Key issues for analysis will focus on developing an inventory valuation model that addresses key concerns (production cycle, peak season inventory, cost of destruction, etc.); key event triggers/scope (covers pests/disease, natural hazards, etc.) pricing and coverage terms.

• Quarantine and regulated pests and non-regulated pests/crop health. The report recognizes that growers lack access to financial risk management tools, such as government compensation in the event of plant destruction or cessation of shipping related to Canadian Food Inspection Agency-imposed quarantine actions. Government should be lobbied to provide compensation for destruction of crops related to this risk.

A production insurance mechanism could also positively influence the management of this risk.

Other recommendations to help mitigate this risk include increasing the number of minor use pesticides available to Canadian growers to be more in line with the number of products available to U.S. growers.

• Hiring and retention. Most growers address the need to retain competent full-time staff and have developed incentives such as return bonuses, profit-sharing, graduated wages, etc. However, it is imperative that the government continue its support of the Seasonal Agricultural Worker Program (SAWP) and also review possible tax incentives to alleviate the added cost of this program where the local labour pool is insufficient to meet demands.

• Energy pricing. Alternative fuels should be evaluated on a regular basis, incorporating the cost-benefit analysis of new technologies. Energy price volatility can be managed through the development of association-wide programs that will address individual grower obstacles such as minimum use/purchase requirements and capital requirements. Other recommendations include leveraging regional programs to access long-term energy contracts and developing widely accessible fixed price energy contracts.

Both Aalbers and Weerdenburg noted that growers have been impacted greatly in recent years by severe pest quarantine action from the CFIA. Aalbers said greenhouse growers are realizing the impacts of quarantine pests on their business. He noted that floriculture growers are enrolling in certification programs required for export. The inherent risk management facets of these certification programs will definitely provide confidence to private insurers in the development of risk management options.

The next step, said Aalbers, is to investigate products and risk management tools that could be made available to growers to mitigate variability and catastrophic weather risks. Additional funding will be requested from PSRMP to fund development of these next steps.

Weerdenburg says growers can expect to be consulted further as the process progresses. “Grower participation does not stop here,” she explained. “The first phase was very necessary and the next phase will again require input from growers and the insurance industry.

Development of the report was funded entirely by the Agriculture and Agri-Food Canada’s Private Sector Risk Management Partnerships (PSRMP). This initiative is designed to help the agricultural industry find risk management solutions through products and services developed and delivered by the private sector.

Growers can contact Weerdenburg or Aalbers to be mailed a copy of the report. It has also been posted to the FCG and CNLA websites.

• www.flowerscanadagrowers.com

• www.canadianursery.com

Print this page