The average garden centre in Canada is located in a rural setting,

measures about 16 acres in total size, brings in annual sales that fall

between the $1 million and $2,999,999 mark and is run by one owner who

puts in more than 50 hours a week during the peak season.

The average garden centre in Canada is located in a rural setting, measures about 16 acres in total size, brings in annual sales that fall between the $1 million and $2,999,999 mark and is run by one owner who puts in more than 50 hours a week during the peak season. This is just a glimpse of the information that we gleaned from our first ever Canadian Garden Centre & Nursery National Reader Survey, which kicked off in November last year.

The survey was distrubuted through our e-mail subscription list and we received a response rate of 8.6 per cent of our list. We were thrilled to hear back from so many of our readers and to learn about their garden centres, their employees, their sales and their challenges. After compiling the data, we can now provide you with information that will give you insight into the Canadian garden centre industry as well as numbers that you can use to benchmark your business.

The garden centre

The majority of our respondents (63 per cent) are the sole owners of an independent garden centre located in a small town (population below 10,000) or a rural setting. Urban garden centres ranked second with 28 per cent. Eighty-six per cent of garden centres have just one location, seven per cent reported an additional store and only three per cent have between two and five locations. Garden centres aren’t a new addition to the retail world, as the typical age of an operation is 25 years. We heard from businesses just starting out in 2011, a few with more than 75 years of business under their belt and one that was even celebrating its 170th year.

|

|

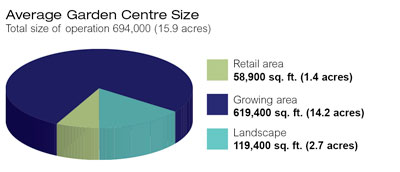

The sizes of garden centres across Canada vary greatly due to the fact that some have growing and landscaping facilities on site, which influences the overall size of the operation. On average, the total size of a garden centre comes in at 694,000 square feet, or roughly 15.9 acres. Looking at the retail space specifically, this measures 58,900 square feet (1.4 acres) and the average growing facility comes in at 619,400 square feet (14.2 acres). A smaller percentage of our respondents (27 per cent) reported having some type of landscape division, which occupies 119,400 square feet or 2.7 acres.

The people behind the plants

Garden retailers are dedicated to their store – 50 per cent clock in more than 50 hours at the business and 28 per cent put in between 41 and 50 hours. Luckily, they’ve got some backup. One to 10 employees are on hand to help 45 per cent of garden centres, 26 per cent say that they have between 11 and 20 staff members and 11 per cent have as many as 30 people to split the workload.

|

|

| Average Employee Wages |

When it comes to training, 42 per cent say they or an employee at the garden centre is trained in retail and/or retail management. That number increases when the training is specific to horticulture – 68 per cent of garden stores have a staff member with formal education in the horticulture sector. In terms of product and sales knowledge, regular training throughout the year is a priority for 62 per cent of garden stores.

|

|

| Annual Salary Range

|

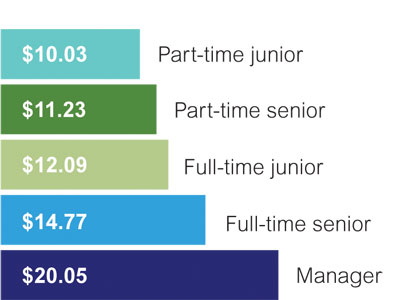

The annual salary for a garden centre operator ranges from less than $20,000 a year (reported by 24 per cent, the highest percentage) to the next most popular brackets at $21,000 to $30,000 or $61,000 to $80,000 (14 per cent each). Seven per cent say they take home a salary of more than $100,000 a year. From a staff perspective, a junior part-time employee with little experience typically makes about $10.03/hour, a seasoned part-timer receives $11.23/hour, a junior full-time staff member earns $12.09/hour and a senior full-time hire will get $14.77/hour. A manager or supervisor commands the highest salary on the employee roster, usually making, on average, $20.05/hour.

But it’s not always about money – garden centres also reward positive employee performance with incentives. Twenty-nine per cent use store credit or gift cards to say thanks, 20 per cent go with cash bonuses, 16 per cent offer merit raises, and 12 per cent opt for education reimbursement. We asked retailers to list any other ideas they might have and these included a company-matched RRSP, store discounts, profit sharing, a seasonal allowance of annuals for employee homes and surprise perks like lunch, dinner, ski packages, or even trips.

Making the sale

According to the 2011 Canadian Garden Centre & Nursery National Reader Survey, 27 per cent of garden centres say the average sales figure per year for the store falls between $1 million and $2,999,999. The second most popular annual sales figure is between $100,001 and $500,000 (24 per cent), followed by $100,000 and under (21 per cent).

From 2008 onto 2009, the majority of garden centres saw sales figures increase – 25 per cent witnessed a jump of 10 to 20 per cent, 29 per cent reported a one to nine per cent increase and 12 per cent said the numbers came in about the same as they were in 2008. Only 11 per cent experienced a decrease in sales from one to nine per cent. When our survey went out at the end of 2010, 39 per cent of our respondents anticipated that their numbers would increase from one to nine per cent over 2009. Nineteen per cent said they were hoping for an increase of 10 to 20 per cent over the previous year and an optimistic nine per cent predicted a jump of more than 20 per cent. Echoing the 2009 over 2008 comparison, 11 per cent of garden centres expected to be down by one to nine per cent in 2010 from 2009.

Looking specifically at profit margins, 27 per cent of retailers estimate this number to be one to four per cent of sales and 22 per cent report a margin of five to 10 per cent. Twenty per cent struggle in this area and responded with “Profit? Are you kidding me?” On the opposite end of the spectrum, the same percentage of garden stores enjoy a profit margin of 11 to 20 per cent and a lucky 11 per cent say this number is 20 per cent of sales or more.

It’s no surprise that 45 per cent of these sales come from the spring selling season from March to May. The summer months of June, July and August account for 33 per cent of sales, with fall coming in at 15 per cent and December, January and February bringing in just seven per cent of annual sales.

According to 30 per cent – the highest percentage – of our respondents, the average transaction in a garden centre rings in between $41 to $60, while 20 per cent of retailers typically receive $20 to $40 with each sale. Twenty-one per cent see their customers open their wallets a little wider and shell out $61 to $80 each time they walk up the register. A small percentage of retailers (12 per cent) must know the secret to add-ons, as they rake in more than $200 on a transaction.

Stocking your benches

Our survey asked garden centre retailers to select all the products they are currently offering their customers in their stores. Perennials were selected as the number 1 product in the average garden centre’s product inventory, followed by annuals, shrubs, trees, seeds, pottery, pest controls, fountains/statuary, tools and home décor to round out the top 10.

When asked what new items they are looking to add to their inventory in the coming 12 months, retailers selected fashion accessories as the most wanted category for 2011. Other selections included birding, gift baskets, home décor, outdoor furniture, tools, dried and permanent botanicals, water gardening, handcrafted items and bulk materials. The number 1 goal in adding these lines is to increase revenue (29 per cent) although some garden centres also hope to attract new clients (28 per cent), diversify product lines (22 per cent) and add higher margin lines (13 per cent).

The survey also polled garden centres on their bestseller for the 2010 season. Popular answers included home décor items, giftware, outdoor furniture, bulk materials, fertilizer, and bagged soils and mulch.

Marketing your garden centre

Canadian garden centres primarily depend on sales promotions (21 per cent) and in-store promotions (17 per cent) to drive traffic to their operation. Advertising also plays a big role for some – 17 per cent place ads in their local newspaper, 14 per cent advertise online, nine per cent turn to social media and eight per cent have a television or radio presence. Other marketing responses and ideas include billboards and community signage, speaking at local horticulture society meetings, garden shows or for local groups and industry magazines. Twenty-six per cent leave advertising in the hands of the customers and rely on word of mouth to get their name out.

|

|

| How Did You Drive Traffic to Your Centre in 2010?

|

When it comes to marketing, the numbers show that retailers are neglecting some very powerful tools that could help them better read and reach their customers. A point-of-sale system is a great way to track customer purchases, manage the day-to-day business and monitor sales, but garden centres are split when it comes to employing such a program in their garden centre – 49.5 per cent say they have one but 50.5 go without. The web continues to grow in importance for consumers and shows no sign of stopping. Eighty per cent of retailers have websites for their business, which means 20 per cent of retailers are missing in action when their customers Google them for product listings, contact information or even just hours of operation. Sixty-five per cent say they don’t publish a regular e-newsletter, missing another great way to establish a relationship with shoppers. For those businesses that do blast out regular e-mail messages, monthly is the most popular option (17 per cent), followed by quarterly (seven per cent), biweekly and weekly (both four per cent).

Some computer-savvy retailers have jumped aboard the social media bandwagon – 37 per cent are on Facebook, seven per cent use Twitter and five per cent have signed up with LinkedIn.

Last but not least, customer perks can also be a factor that shoppers consider when deciding to shop with you. Thirty-seven per cent of garden centres offer customers a loyalty program and 62 per cent have a plant guarantee program set up at their store.

Challenges and opportunities

It’s no secret that 2010 was a tough year for the retail sector as a whole and the garden market was no exception. However, this industry is unique in the sense that it’s vulnerable to one factor that retailers can rarely predict or control – the weather. Mother Nature was selected as the biggest challenge of 2010, with the general economy and competition from big-box stores ranking as second and third. Other threats to business included a changing customer base, staffing issues, changes to housing construction levels and access to credit. With the exception of the weather – which 46 per cent say is a major threat – the majority of our respondents believe that all of these hurdles are manageable challenges.

|

Looking ahead to the next 18 months, retailers still fear spring’s fickle nature, as weather remained the number 1 challenge for the coming year along with the pressure put on by big-boxes and mass marketers. The economy also has the potential to pose problems if the recovery doesn’t go as planned.

The good news is that several opportunities also lie ahead. We asked retailers to grab their crystal ball and predict which trends they’ll be able to capitalize on in the next two to five years. New gardeners and the younger generation is the highest-ranking opportunity, according to our survey, with 54 per cent of our respondents citing this as a significant opportunity (as opposed to “somewhat of an opportunity” or “not really a factor”). Following in a close second, and also labelled as a significant opportunity, is the trend towards “stay-at-home” or “stay-cation spending.” The buy local movement or grow local movement and baby boomer requirement are also on the radar.

Canadian Garden Centre & Nursery would like to thank all of the retailers who took the time to complete our survey. Our survey was anonymous; however, respondents had the opportunity to enter their name to win a GPS system. We’d like to congratulate Annette Weesjes of Family Flowers Inc. in St. Thomas, Ont., who was selected in a random draw as the winner.

| Canada’s independent garden centre sector is…

GROWING PROFITABLE CHALLENGING LOOKING TO THE FUTURE |

Print this page