Features

Business

Trends

Grower Survey: Divulging plans for 2021

In a survey conducted earlier this year, greenhouse producers shared highlights from 2020 and plans for expansion, technological investments and more in 2021.

June 8, 2021 By Greta Chiu

The Greenhouse Canada grower survey returned for 2021 this year, taking a snapshot of the industry as the Canadian economy continues to deal with the effects of COVID-19.

Who answered

We received 75 qualified responses from producers in the controlled environment agriculture sector in Canada. Knowing that, it’s best to treat these results as informal or anecdotal. Because some growers selected a mix of different growing spaces and/or crops, percentages won’t necessarily add up to 100.

Among the respondents, 87 per cent were growing in greenhouses and 12 per cent producing in vertical farming or another type of indoor growing space.

Ornamental and vegetable growers were targeted in this survey. 65 per cent identified as retail growers, while another 62 per cent identified as being wholesale and/or young plant growers.

Some chose “other”, focusing on crops such as herbs, plants used for reclamation sites or host plants for pests.

In terms of province, the majority were located in Ontario (43 per cent), followed by Alberta (28 per cent), British Columbia (15 per cent), Saskatchewan (9 per cent), with some representation from Nova Scotia, Manitoba, Newfoundland & Labrador, Quebec, Prince Edward Island, and the Yukon.

Over 55 per cent of respondents worked in operations measuring under 50,000 square feet, where half of this group was made up of retail growers. The rest of the operations were fairly evenly spaced out between 50,001 to 350,000 square feet, and over 1,000,000 square feet.

The majority grew product for their own retail shop (43 per cent), wholesalers (33 per cent), and mass merchandisers/box stores (28 per cent), followed by independent garden centres (21 per cent) and other growers (19 per cent).

We also asked growers to identify the crops they primarily grow. Here were some of the frontrunners (i.e. not exhaustive).

Ornamentals: Flowering potted plants (39 per cent), ornamental bedding plants (37 per cent), perennials (33 per cent), tropicals (22 per cent) and cut flowers (17 per cent).

Vegetables: Tomatoes (46 per cent), peppers (39 per cent), cucumbers (36 per cent), strawberries (25 per cent), eggplant (20 per cent), leafy greens (32 per cent), herbs (39 per cent) and microgreens (7 per cent).

Sales and profits in 2020

When compared to 2019 sales, 70 per cent of respondents reported an increase in sales. 44 per cent experienced an increase by more than 10%, 16 per cent saw increases between 5 and 10%, while 10 per cent said sales increased by less than 5%. 12 per cent experienced declines in sales.

Breaking down the numbers a bit more, 85 per cent of retail growers said they experienced increases in sales. For wholesale growers, this was 62 per cent, whether combined or broken down by crop group.

How did growers net out with costs in tow? 66 per cent reported increases in profit margins, while 14 per cent reported declines.

Forecasting for 2021

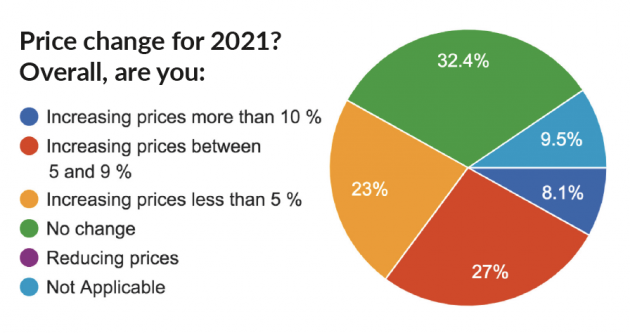

Price-wise, none of the respondents indicated any plans to reduce prices. 58 per cent will be increasing them, with 50 per cent looking to raise prices by up to 10% (rounded up). 32 per cent of respondents will be holding steady.

Sales forecasts are looking great. In total, 75 per cent of respondents said they’re expecting higher sales for 2021 compared to 2020. 41 per cent expect sales volumes to be up by 10% or less, while 35 per cent expect this rise to be more than 10%.

Inputs in 2020

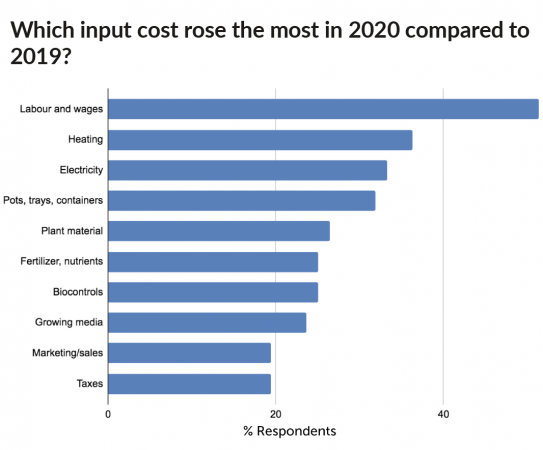

A number of input costs rose in 2020. When asked to identify three inputs that increased the most in cost, 51 per cent of respondents identified labour and wages as one of the top. This was followed by heating, electricity, and pots/trays/containers.

For most growers, there was no change to their use of biocontrol agents and biopesticides, regardless of whether they were applied against mites and insect pests or diseases. To clarify the definition of these products, the survey specifically noted that biocontrol agents included predators, parasitoids, and pathogens, while biopesticides included living microorganisms and chemicals derived from natural sources including mineral oil.

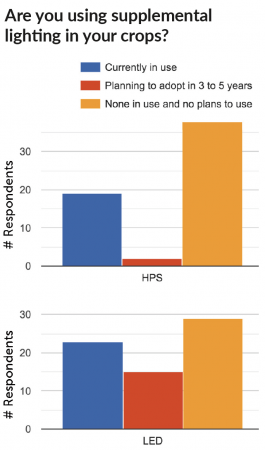

As for lighting, 34 per cent of surveyed growers indicated that they currently use LED lighting, with 22 per cent looking to adopt this technology in the next three to five years. In general, a greater number of producers expressed interest in adopting LED over HPS, supported by a higher level of disinterest in adopting HPS compared to LED lighting.

Labour

Cited as the input cost which rose the most last year, over half of the survey respondents said there were no changes to the level of labour employed in their operations last year. 38 per cent found that this number rose.

For 2021 however, 51 per cent believe that their labour needs would rise. Less than three per cent forecast a reduction in labour.

Expansion

Almost two-thirds of surveyed producers said they did not expand in 2020. One fifth said they expanded by less than 10,000 square feet, while eight per cent expanded between 10,001 and 25,000 square feet.

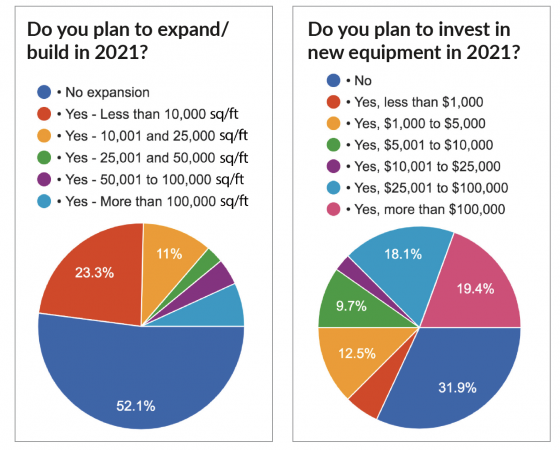

Plans for expansion were a completely different story for 2021. Almost one-half plan to expand this year. Two-thirds also plan to invest in new equipment, with 19 per cent looking to spend upwards of $100,000, and 18 per cent planning to spend between $25,000 and $100,000.

Social Media and online retail

Social media use for work was very fragmented among the respondents. 31 per cent said they use it occasionally (approximately several times per week), another 30 per cent either use it rarely (a few times a year) or not at all. 21 per cent use it frequently to very frequently, checking once or more than once per day.

Looking specifically at the retail segment, this group appeared to have a higher rate of social media use. 15 per cent said they do not use or use social media very rarely. 29 per cent use it a few times a month, while 25 per cent use it several times a week. 31 per cent use it frequently to very frequently.

Also looking specifically at retail, 54 per cent said they already have e-commerce platforms set up on their website. However, 31 per cent have stated that they do not, and have no plans to do so.

Challenges and Opportunities

Coming out of the first year of COVID, surveyed producers cited the biggest challenges as unclear regulations and temporary closures of sales points. This was followed by difficulty in recruiting local workers. Housing issues, lost or delayed temporary foreign workers, reduced markets, and issues with access to personal protective equipment all rounded out the last of the more popular answers.

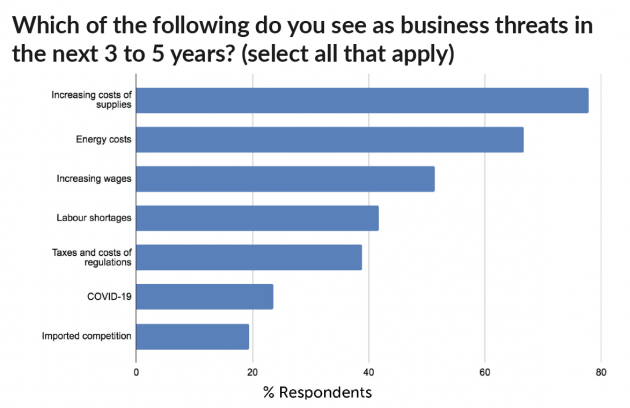

Corroborating with previous answers, the majority of respondents identified increasing cost of supplies (78 per cent), energy costs (67 per cent) and increasing wages (51 per cent) as the top three business threats in the next three to five years. Only 24 per cent saw COVID as a potential threat.

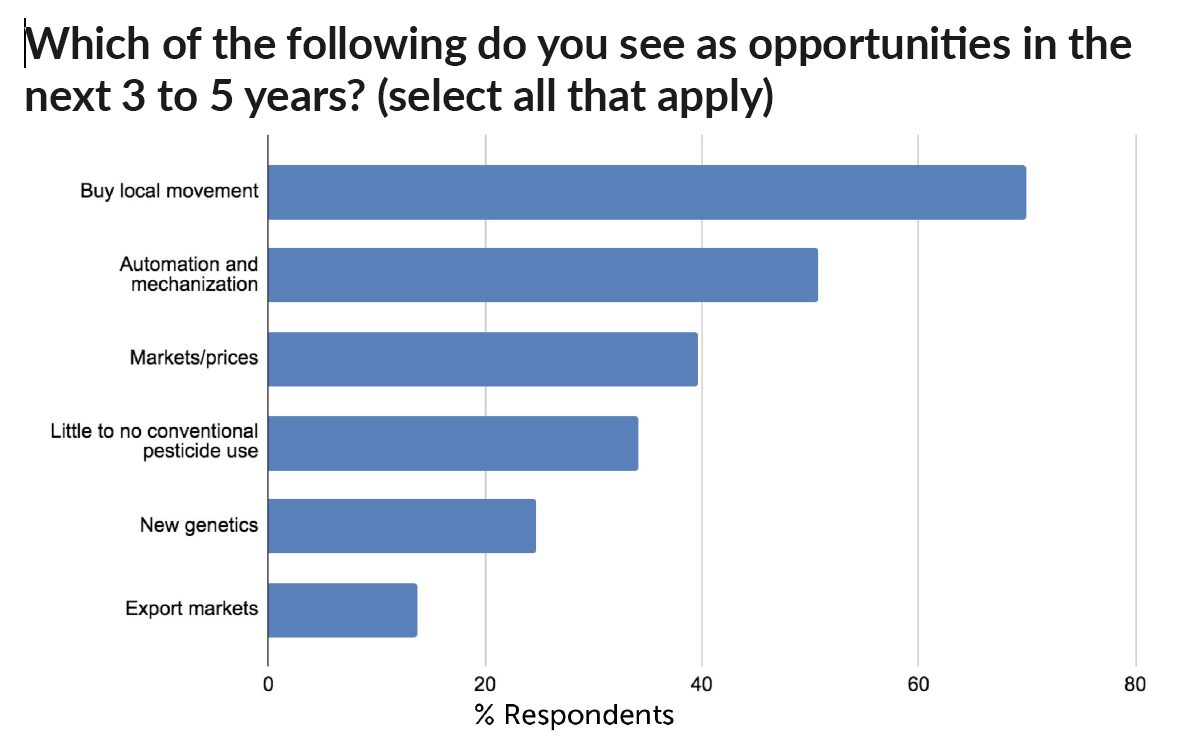

As for opportunities, the buy local movement received a nod by 70 per cent of survey takers. This was followed by automation and mechanization (51 per cent) and markets/prices (40 per cent) and little to no conventional pesticides needed (34 per cent).

Print this page