Features

Business

Crops

Energy

Inputs

Structures & Equipment

Four decades of change and innovation

Pivotal moments in 40 years of Canadian greenhouse history.

December 8, 2020 By Greta Chiu

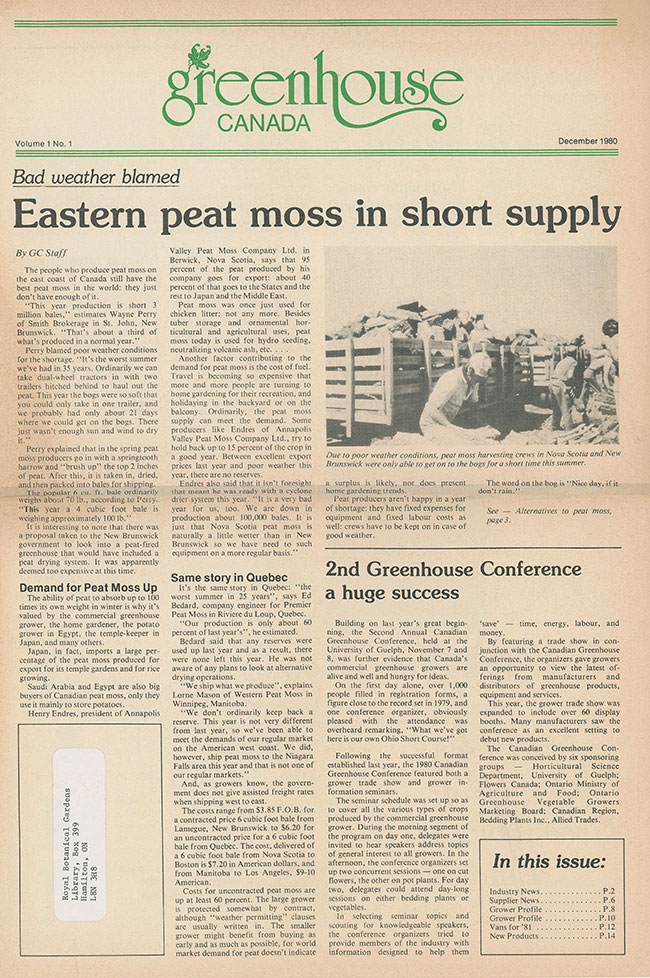

The very first issue of Greenhouse Canada, dated December 1980. (Image courtesy of E. Aults, Royal Botanical Gardens)

The very first issue of Greenhouse Canada, dated December 1980. (Image courtesy of E. Aults, Royal Botanical Gardens) To commemorate 40 years of coverage, Greenhouse Canada reached out to some of the industry’s longest standing specialists to highlight pivotal moments in greenhouse history. Here’s what they had to say.

Structures and practice

For tomatoes, the early to mid-90’s were characterized by a series of structural and production changes that allowed rapid economic growth, paving the way to U.S. markets. “That’s when the sector really started to move forward,” says Shalin Khosla, former greenhouse vegetable specialist with the Ontario Ministry of Agriculture, Food and Rural Affairs (OMAFRA)

During this time, greenhouse vegetable producers adopted rockwool, hydroponics and double-poly greenhouses at an exponential rate. Researchers successfully bred for resistance against fusarium crown and root rot into red tomatoes, allowing producers to diverge from a limited market for resistant pink tomatoes.

Methods for vegetable production evolved again in the 2000’s with the emergence of troughs. “First came tomatoes because of the ease of handling and better [greenhouse] climate,” says Dr. Mohyuddin Mirza, long-time greenhouse consultant in Alberta. Cucumbers closely followed, moving away from the older ‘V’-system to embrace high-wire production.

Aided by higher greenhouse roofs with tempered glass and more efficient coverings that appeared from 2000 to 2010, both greenhouse vegetable and ornamental growers benefited from rapid improvements in light transmission and diffusion, heat retention and air movement.

Energy management

“When I started… 50 cucumbers/ m2 was the standard,” says Mirza, “But some are now [at] over 280 cucumbers/m2.” The emergence of energy-managing technologies such as climate screens certainly helped, but grower knowledge of when and how to use them also played a large role.

Generating electricity, heat and carbon dioxide all in one package, co-generation was a big development for Alberta and other parts of Canada. Mirza recalls the use of smaller generators around Medicine Hat, Alta. in the late 90’s and early 2000’s. The interest was clearly there, but it wasn’t until 2015 that the technology became more prominent among greenhouse vegetable growers.

Along the same lines, flue gas condensers and ‘heat dump’ tanks continue to be “must-have” items for large-scale greenhouse development, says Gary Jones, faculty member at Kwantlen Polytechnic University, B.C. “This technology has had, and continues to have a significant return on investment…”

In line with global outlooks, the current goal is to achieve carbon-neutrality. “Hopefully by 2050, we’ll be able to come close,” says Mirza.

Automation

No more manual dials of the thermostat or chain-pulling to open vents. Climate computers emerged in the late 70’s and early 80’s, but progressed to more sophisticated software and a wide range of accompanying sensors in the early 2000’s. “It allowed [growers] more time to work in the crop rather than adjusting vents and heating,” Khosla says. Relying on data, the computers provided efficiency and consistency in the greenhouse environment to improve production and resource use.

With increasingly sophisticated communications networks in place, growers can send and receive information and data analyses in real-time, adds Mirza. Is the crop under stress? Immediate changes can be made to the greenhouse climate from a mobile device.

As noted by both Greenhouse Canada’s former editor Dave Harrison and Québec greenhouse consultant Michel Senécal, the move towards automated systems has helped lower costs and ensure more uniform and consistent yields and quality. “Whether for internal transport in greenhouses, workers’ tasks, product deliveries (flowers, vegetables, etc.), inventory management, greenhouse climate management, etc., these innovations have significantly reduced production and labour costs,” says Senécal.

Artificial intelligence is also lending an additional perspective. With the many sensors and data being gathered, management and analysis is now critical. “You can monitor the plant more closely, to synthesize data together, give reasons for why your plant might not be performing,” says Mirza.

New crops and breeding

Seedless cucumbers appeared in the early 80’s, followed by peppers in the early 90’s. Along with beefsteak tomatoes, these three crops largely dominated the greenhouse vegetable sector well into the late 90’s.

“But that soon changed with the introduction of mini varieties, cluster tomatoes, strawberries and eggplant,” says Harrison. “New crops mean new customers,” and growers continue to explore the cultivation of new crops under cover.

For floriculture, the 2000’s saw a surge in garden mums bred with excellent habits, but their lost hardiness relegated the crop to fall pot production, says Melhem Sawaya, veteran greenhouse consultant in Ont. The number of poinsettia varieties also rose rapidly, with over 200 varieties now available on the market.

Over the last ten years, different and unique crops began taking the place of old favourites. Growers started adopting nursery cultivars, such as flowering shrubs, and repackaging them for containers and gardens, says Sawaya. Impatiens almost completely disappeared from the market due to downy mildew, though new breeding has promised to resurrect the crop. Recent cross-breeding in begonias has led to a surge in its use as bedding plants, particularly as breeders prioritize for vigour.

Pollination around-the-clock

Unable to import bumblebees being used in European greenhouses, Canadian researchers worked to capture, breed and domesticate native bumblebee populations in the late 80’s/early 90’s. One species worked particularly well in the eastern part of the continent. Trialled for just one season prior to commercial adoption, “that was one of the fastest technology transfers that occurred,” says Khosla.

Previously, growers would use the electric bee, a toothbrush-sized apparatus to vibrate each individual flower. Agitating pollen from the anthers for a greater chance of contact with the stigma, this process was conducted between 10am and 2pm each day. But once the bees arrived, they took on the job 24/7, says Khosla. Good pollination also led to more uniform fruit shape and size from start to finish. He estimates that the bumblebee’s arrival improved production by five to 10 per cent.

Lighting and year-round production

Some of the earliest lighting work on cut roses was led by Dr. Jim Tsujita at the University of Guelph, recalls Sawaya. Sparse LED use started to surface in floral production in the 90’s, but it wasn’t until the 2010’s that lighting was adopted on a larger commercial scale.

“Production seasons used to largely reflect natural light levels and meant winter shut down,” says Harrison. “But research on lighting has led to more growers able to consider year-round production, something so critical in assuring retailers they can expect greenhouse produce virtually year-round.”

In Ontario, supplemental lighting has allowed for winter production, opening new markets and gaining market share. Productivity increased 1.5 to 2 times for cucumbers, and 15 to 20 per cent in tomatoes, says Khosla. Light research for peppers started in the late 2000’s and improved production by 10 to 20 per cent

While metal halide and high-pressure sodium fixtures were, and continue to be, used in floriculture and vegetables, a new form of lighting is taking centre stage.

The low-energy input of LEDs makes “year-round vegetable production a real possibility in many places that could otherwise not entertain the idea,” says Jones. “[It] has spawned a whole new area of science in developing light recipes specific to individual crop species [and management of] … previously unthinkable plant characteristics….”

While producers experiment with a mixture of top HPS and LED interlighting, says Mirza, one Albertan grower has successfully grown tomatoes under LEDs for the past four years. It’s also increased yields, adding 4 to 8 kg/m2 to yearly totals.

What’s holding LED back from large-scale adoption? High initial costs and a lengthy return-on-investment period, says Sawaya. But once the technology becomes more affordable and established, he adds, “I can see some of the imported [floriculture] stock materials from Africa and South America being produced locally at a lower cost and with better quality, even though labour costs are much higher here.”

Jones relates the rise of urban agriculture to horticultural innovations such as LEDs, along with keen interests in renewable energy and local food production. “[Urban agriculture] has seen a gradual creep into the everyday consciousness over several decades, but really exploded in the last decade in large cities here.”

Plug production

Near the end of the 70’s, a new ornamental technique emerged in the form of plugs. “The idea that each seed be sown individually in a cell in a multicellular tray was revolutionary at that time,” says Senécal, who attributes the work to David Koranski, Roger Styer and Melhem Sawaya. “Producers quickly adopted this technique, which has become the standard even today.”

Machines used for seeding plug flats followed in the early 80’s. With these mechanical transplanters, a crop and a half was easily achievable, says Sawaya.

Another hallmark of the 80’s was Impatiens walleriana, a new crop that took the sector by storm. “[In] some greenhouses, 70 per cent of their flat production was Impatiens,” says Sawaya, “and [it] was the first item to run out.” Growing Impatiens was relatively straight forward, and it greatly simplified production for those cultivating a large proportion of it. “The synergy of producing plug flats under [metal halides] cut production time drastically [and produced] a better-quality product for the consumer,” says Sawaya. They made up for the increasing costs of labour, production and transportation at the time, without needing to increase prices.

Greenhouse Canada through the ages

Big box stores and marketing

Marked by the opening of Home Depot in 1978 and Costco in 1983, big box stores opened up retail sales on a large scale, providing growers with mass volume customers and allowing economies of scale that were unknown before, says Jones. “Their influence on market trends is enormous. But…they also have had a massive influence on prices with deep discounting and a consequent influence on margins,” impacting the consolidation of the industry.

A surge in vegetative cuttings appeared in the 90’s, promoting greater uptake of larger container sizes to absorb the higher plant material costs, says Sawaya. Bedding flat production dropped while patio containers rose. A combination of production efficiency and lower retail prices led to production based on speculation and resulted in oversupply.

In comparison, the 2000’s saw more production programs taking place between buyers and growers in Ontario, says Sawaya. There was less speculation and more production to order. This period also saw the emergence of consumer-facing brands, such as Proven Winners, Simply Beautiful and Flower Fields, as well as pay-by-scan among certain chains.

More recently, COVID was, and still is, having a large impact on ornamental consumption. Foreign workers, consumers, containment, open or closed retail shops and garden centres – it was a flurry of activity, says Senécal.

“COVID-19 made us realize how much consumers love plants and gardening,” says Sawaya. By equipping the consumer with quality product and the right knowledge for plant care success, he hopes this will help keep this momentum going.

Biocontrol, biopesticides and prevention

“Biological control with predators and parasitoids appeared more commercially towards the end of the 1980’s,” says Senécal. Later in the early 90’s, the use of biopesticides emerged, encompassing biological bactericides, fungicides and insecticides.

Now commonly used as biocontrol agents, whitefly predator Encarsia formosa and spider mite predator Phytoseiulus persimilis were the first two documented commercializations of biocontrol in Canada. They were notably resurrected by Applied Bio-nomics and Don Elliott in 1980, building on previous work of researchers and companies in the 30’s and 50’s, says Jones.

Uptake was quick. By the late 80’s, 75 per cent of Ontario’s tomato growers were using biocontrol for whiteflies, though rare in cucumbers or peppers, says Cara McCreary, OMAFRA greenhouse vegetable IPM specialist. Fast forward to 2008, and 100 per cent of Ontario’s greenhouse vegetable growers were using biocontrol. And it’s no wonder. Major commercial introductions included thrips predator Amblyseius cucumeris in 1986, aphid parasitoid Aphidius matricariae in 1989, whitefly predator Dicyphus Hesperus in 2000 and thrips predator A. swirskii in 2006.1,2

Biopesticides followed closely behind. In 2002, five were registered for greenhouse use in Canada, McCreary reveals. By 2016, this number grew to 36.

Biocontrol and biopesticides have played a large part in the changing greenhouse landscape. Not only have they reduced conventional pesticide use, but they’ve improved pest management, reduced the chances of developing resistance and made the greenhouse a safer place to work, says Jones.

For biocontrol efficacy, OMAFRA turned the emphasis on prevention by developing a scouting and systematic monitoring system in the late 80’s to early 90’s before it was commercialized by the private sector.

The arrival of the pepper weevil in 2016 led to significant improvements to greenhouse biosecurity programs, says McCreary. “Pepper weevil is a hitchhiker,” she explains, which meant that preventative practices included more sanitation and measures to reduce outside contamination. There were notable increases in the installation of exclusion screening. Efforts were made to move packaging facilities away from production facilities to manage imports arriving from areas native to the pepper weevil. All this prepared producers for the threat of the tomato brown rugose fruit virus last year, as well as this year’s COVID-19 pandemic.

Research continues to yield new tools for pest management, including scouting software and mobile apps for monitoring plant health, counting pests and more, emphasizing and increasing ease of prevention.

Legalization of recreational cannabis

The legalization of recreational cannabis in October of 2018 was easily one of the most high-impact events in the greenhouse sector within the last three years. The sudden growth of cannabis operations put a strain on the existing greenhouse industry, says Sawaya. It hiked up the cost of new builds, tied up services and supplies, and funnelled an already shrinking pot of skilled workers into cannabis. Plus, “many floriculture operations sold to cannabis producers, which created a shortage of product for the flower industry,” he adds.

As Jones notes, “…the introduction of this crop affected the prices of other crops, brought in outside financial investments on a scale we have never seen before, attracted people and expertise into horticulture who were never part of the industry prior to this and sadly, impacted the day-to-day lives of many people who had worked in greenhouses but who were subject to layoffs. This story is far from finished.”

For coverage of this year’s COVID hurdles, stay tuned for a state of the industry roundup in January 2021.

1 Applied Bio-nomics, Online 2G. Ferguson, Presentation.

Print this page