After some challenging years characterized by economic uncertainty and

cutbacks in consumer spending, things are starting to look up for the

garden centre and nursery industry.

After some challenging years characterized by economic uncertainty and cutbacks in consumer spending, things are starting to look up for the garden centre and nursery industry. The results of our 2012 Canadian Garden Centre & Nursery Reader Survey show that customer counts were up last year, and so were sales averages, suggesting that the industry may be in for sunny days ahead.

We asked you to help us help the industry learn a little more about itself, and that’s exactly what you did. From Feb. 12 through March 14, garden centre and nursery operators and managers from coast to coast answered questions about all aspects of their operations. From staffing and pay scales to sales and marketing, we’ve dug through the data to bring you a snapshot of your industry. Sit back, relax, and read on to see how your business compares with garden centres and nurseries from British Columbia to Nova Scotia and everywhere in between.

By the Basics

Many of our respondents are going it on their own, fighting for market share in a retail environment that’s often dominated by big box stores. The vast majority are either sole owners (69 per cent) or co-owners (25 per cent) of an independently owned garden centre. Very few are part of a larger chain of garden centres (four per cent) or a retail grocery or hardware chain (three per cent).

|

|

Forty-six per cent of respondents indicated that their retail operation includes a greenhouse operation, closely followed by 45 per cent who reported that a nursery supports their retail business. Just nine per cent of respondents indicated that their retail operation includes a floral outlet.

Geographically speaking, the largest pockets of respondents who operate garden centres and nurseries are concentrated in Ontario (43 per cent) and British Columbia (27 per cent). Alberta (12 per cent), Saskatchewan (five per cent), Quebec (four per cent) and New Brunswick (four percent) are home to smaller shares of respondents. The remaining provinces and territories each account for two per cent or less of all responses collected during this year’s survey.

Collaboration and co-operation to build a stronger industry is an important part of doing business for almost two-thirds of our respondents. More than six in 10 (64 per cent) are members of a provincial horticulture association, the Canadian Nursery Landscape Association (CNLA) or Garden Centres Canada.

Staffing Stats

During peak gardening season, long hours are the norm for many of our respondents. Fifty-seven per cent work more than 50 hours per week from March through October. Fortunately these hard-working garden centre and nursery owners and managers have help tending to their businesses.

|

|

Our respondents employ an average of six full-time staff and five part-time permanent staff. A full complement of seasonal staff are also hired to keep things running smoothly during peak season. On average, nine full-time and 11 part-time seasonal staff are brought on board to pitch in when the going gets crazy.

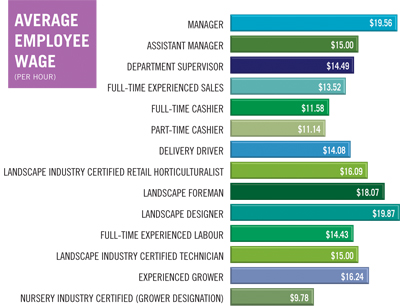

How staff are compensated for their efforts depends on their position in the garden centre or nursery, as well as their experience. The average part-time cashier makes $11.14 an hour, while their full-time counterpart rings up $11.58 per hour in wages. A manager earns $19.56 per hour on average; an assistant manager makes $15. Staff also receive compensation in the form of vacation pay (23 per cent), discounted pricing on stock (22 per cent), flex hours (17 per cent), Christmas bonuses (12 per cent), overtime pay (11 per cent) and health benefits (nine per cent). A handful of respondents offer their staff profit sharing (two per cent), pension plans (two per cent), social committees (two per cent) and commission (one per cent).

Retail, sales and marketing training are important components of staff development at many garden centres and nurseries. More than half of the owners and managers surveyed (57 per cent) report that either a staff member or they themselves have formal training in retail, retail management or marketing. Fifty-seven per cent of respondents report that their centre offers regular product and sales training.

Advertising and Marketing

When it comes to marketing their businesses, our respondents rely on a variety of tools to do the job. Last year, respondents reported spending a full 10 per cent of total retail sales on advertising, including newspaper, radio, TV, flyers, billboards, websites, direct mail and catalogues. Almost nine in 10 of our respondents (87 per cent) reported that their garden centre has a website; just 14 per cent of those websites offer customers the option of making purchases online.

|

Looking at other online marketing platforms, Facebook (46 per cent) is the most popular social media tool for promoting the business. Twitter (22 per cent) and LinkedIn (13 per cent) are less popular social media marketing tools. Almost one in five respondents (19 per cent) report that they don’t use any social media to promote their businesses.

Sales Snapshot

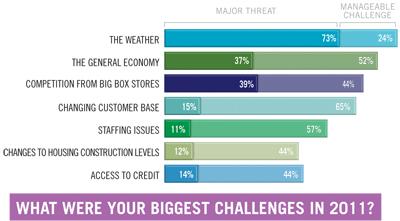

Despite a host of challenges including the weather (mentioned by 97 per cent of respondents), a tough economy (89 per cent), competition from big box stores (83 per cent) and a changing customer base (80 per cent), two-thirds of respondents reported an increase in their customer count last year. Average retail sales were also up last year: the average customer spent $89.37 at checkout in 2011. That’s a big jump since 2010, when the average transaction lay in the $41 to $60 range.

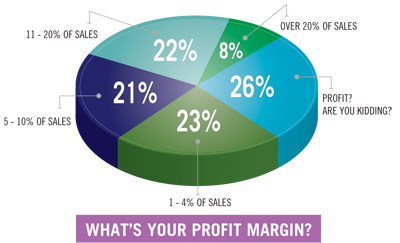

Despite increased customer traffic and higher transaction totals, 2011 was still a tough year for many of our respondents. In response to a survey question asking respondents to estimate their store’s net profit, more than one-quarter (26 per cent) selected the “Profit? Are you kidding?” option.

|

|

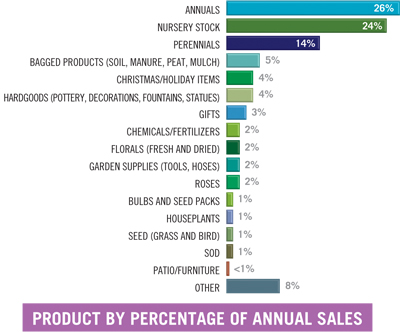

With respect to total retail sales, more respondents indicated that their retail sales fell into the $250,001 to $500,000 range than in any other bracket. Annuals (26 per cent), nursery stock such as trees, shrubs and evergreens (24 per cent) and perennials (14 per cent) accounted for the greatest percentage of total retail sales last year. Bulbs and seed packs (1.4 per cent), houseplants (1.4 per cent), sod (0.6 per cent) and patio and furniture items (0.4 per cent) made the smallest contributions to overall retail sales last year.

|

Overall, retail accounted for 71 per cent of total business sales in 2011. Wholesale to landscapers (10 per cent), landscape installations (nine per cent), wholesale to independent retailers (four per cent) and wholesale to big box stores (one per cent) represent smaller slices of the total business sales pie.

Looking ahead, garden centre and nursery owners and managers are optimistic heading into the 2012 season. More than 80 per cent of respondents anticipate an increase in sales this year. Here’s what respondents are projecting in terms of sales this year:

- Eight per cent expect to see increases above 20 per cent

- Nearly one-third (31 per cent) anticipate that their operation will post gains in the 10 to 20 per cent range

- More than four in 10 (44 per cent) expect a one to nine per cent increase over last year

- 15 per cent believe their sales will hold steady

- Less than one per cent each expect sales to decrease between 10 and 20 per cent, or by more than 20 per cent

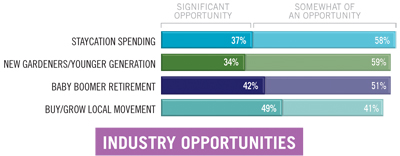

In the coming years, our respondents predict that stay-at-home and “staycation” spending (mentioned by 95 per cent of respondents), new gardeners and the younger generation (93 per cent), baby boomer retirement (93 per cent) and the buy or grow local movement (90 per cent) will present new opportunities for growth.

Building Bridges Coast to Coast

Many of our respondents are interested in national programs to benefit and promote the industry as a whole. Four in 10 (41 per cent) would like to see a national plastics recycling program launch across Canada. One-quarter of our respondents, (25 per cent) would be interested in a national primary school garden centre tour program, and 20 per cent would be interested in a national garden centre awards program.

Just 14 per cent of respondents indicated they would be interested in a national garden centre inspection program.

The 2012 Canadian Garden Centre & Nursery Reader Survey ran in conjunction with the Canadian Nursery Landscape Association and Garden Centres Canada. Thank you to everyone who participated in the annual survey.

|

Canada’s independent garden centre sector is…

ONLINE

87 per cent of respondents have invested in a website for their garden centre, and four in five are on social media

GAINING GROUND

67 per cent of respondents saw their customer counts increase in 2011

POISED FOR GROWTH

83 per cent of respondents expect their sales to increase in 2012

OPTIMISTIC ABOUT THE FUTURE

“Staycation” spending, a new generation of gardeners, and retiring boomers with more time to spend in the garden are big growth opportunities

CHALLENGED BY

The weather, a tough economy and ongoing competition from big box stores

| Making the Sale Just over half of all of our respondents (52 per cent) have a point of sale (POS) system at their garden centre; 45 per cent don’t have a POS system. Two per cent of our respondents indicated that they don’t presently have a POS system, but plan to add one at their garden centre within the next year. When it comes to processing payments, the most popular merchant processing suppliers are: Moneris (33 per cent) Chase Paymentech Solutions (26 per cent) Global Payments (15 per cent) TD First Data (15 per cent) The majority of our respondents (86 per cent) do not offer online shopping and e-commerce to customers; just 14 per cent allow their customers to shop online. |

Print this page