Features

Business

Research

SR&ED in the greenhouse

November 6, 2013 By Brad McDougall and Micheline Tarazi PricewaterhouseCoopers LLP

A profitable greenhouse demands innovation, which can be expensive and risky, but substantial tax incentives can help.

A profitable greenhouse demands innovation, which can be expensive and risky, but substantial tax incentives can help. These incentives reduce the effective cost of work that qualifies as scientific research and experimental development (SR&ED).

SR&ED incentives are offered by provinces (except P.E.I.) as well as by the federal government. Depending on the province, a total credit might be 28 per cent to 46 per cent of eligible costs.

|

WHAT QUALIFIES?

■ On my first tour of a greenhouse operation, the amount of SR&ED activity struck me. The operation was:

- Growing new genotypes, with potential characteristics that are an advancement.

- Determining how environmental variables, tillage practices and other factors influence trait expression and growth rates.

- Finding new methods for dealing with diseases and pests.

- Coming up with more efficient and inexpensive seedling propagation technologies.

At first, the owners may have thought that the “research” aspect meant having people in lab coats. Still, they made a significant claim that was accepted by the Canada Revenue Agency (CRA), their income tax liability disappeared and a significant cash refund arrived.

You can undertake eligible SR&ED projects in conjunction with commercial production if you conduct experimental development – work with the purpose of achieving technological advancement for the purposes of creating or improving products

or processes.

The three requirements are technological uncertainty, systematic investigation by qualified employees and technological advancement.

A – TECHNOLOGICAL UNCERTAINTY

■ The technological uncertainty requirement means the solution must not be obvious, involving technology readily available to you.

So, if the way to avoid a particular plant disease is well documented, there is no technological

uncertainty.

However, there can still be technological uncertainty even if there is a known but proprietary solution that you don’t have access to. For example, you might pursue a cheaper solution.

Non-technological uncertainty won’t do the trick. That rules out business uncertainty, for example, that encountered when introducing a product to a specific market.

B – TECHNOLOGICAL ADVANCEMENT

■ Technological advancement doesn’t require success, just a legitimate gain in new knowledge or capability. Of course, negative results might be used to

develop a different approach. Sometimes the technological advancement is proving that the approaches tested don’t work.

C – SYSTEMATIC INVESTIGATION

■ A systematic investigation must be performed in an attempt to resolve the technological uncertainty.

You have to formulate a clear objective, identify and articulate the technological uncertainty, formulate a hypothesis designed to reduce or eliminate the uncertainty, test that hypothesis, analyze the results of the test and reach a conclusion.

It might not be clear whether a particular project will qualify. The CRA has a pre-claim project review service that will offer a preliminary opinion before you file a claim.

The CRA has also introduced an online eligibility self-assessment tool (ESAT) to help you determine if the work you have done could satisfy the SR&ED requirements. Of course, the CRA makes its final determination only after you file.

|

WHAT CAN YOU CLAIM… AND WHEN?

■ Determining what costs to claim is where industry experience and knowledge really pays off.

Experience with the tax authorities, and their assessing practices and policies, is also crucial. Claim too much and you can expect a tough challenge by the CRA. Claim too little and you leave tax benefits on the table (or in the ground).

Eligible costs include:

- Wages of employees engaged “hands on” in the SR&ED activities, and of support staff conducting directly related activities, including crop work.

- Materials used in experimental efforts.

- The cost of consultants involved, such as those monitoring pests and disease.

- Overhead and other current expenditures.

- Costs of capital assets, including equipment, incurred mainly for SR&ED purposes, for the entire life of the asset, except that capital expenses incurred after 2013 will be excluded.

Identifying SR&ED projects early and preparing them at the time, rather than a year later, helps you track related costs, including employees’ time. Reconstructing costs is time-consuming and likely to produce a smaller claim.

Both current and capital SR&ED expenditures can reduce your income for tax purposes in the current tax year or can be carried forward to reduce it in future tax years.

For example, capital equipment acquired to analyze crop characteristics normally would be capitalized for income tax purposes, and you’d claim annual depreciation (capital cost allowance or CCA). If the equipment qualifies as an SR&ED expenditure, it can be fully deducted in the year it is acquired, until the end of 2013.

WHAT ARE THE TAX INCENTIVES WORTH?

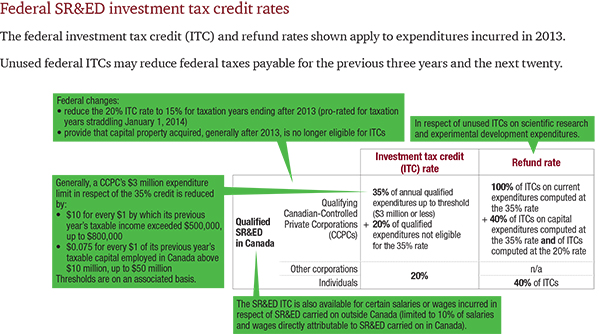

■ The tax benefits depend on the location of the work and are more generous for a Canadian-controlled private corporation (CCPC) than a public or foreign-owned one.

For example, SR&ED tax credits for private corporations and individuals have a refundable component. So, a CCPC with no income tax payable will still get a tax refund, at a credit rate of 35 per cent compared to 20 per cent for public and foreign-owned corporations.

SR&ED tax credits and refund rates shown in the tables in this feature (this and previous page) apply to expenditures incurred in 2013. Unused federal tax credits may reduce federal taxes payable for the previous three years and the

next 20.

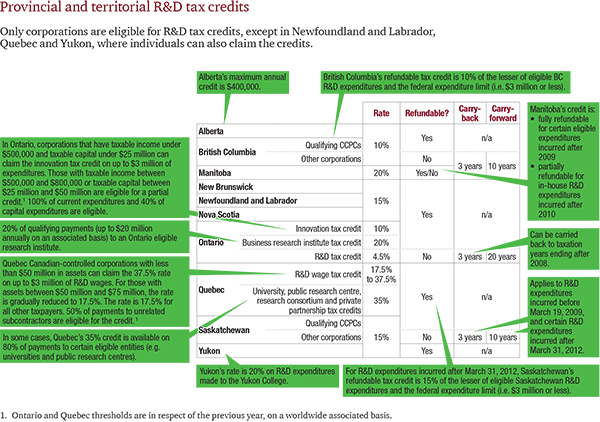

Only corporations are eligible for provincial SR&ED tax credits, except in Newfoundland and Labrador, Quebec and Yukon, where individuals can also claim (see chart below).

|

DOCUMENTING THE SCIENCE AND THE COSTS

■ To get both of the tax benefits from the SR&ED, you have to file tax forms on or before the reporting deadline (12 months after the filing due date of the income tax return for the year).

For corporations, generally the filing deadline is 18 months after the year-end, so year-end of Dec. 31, 2012, means filing forms for the SR&ED claim before

July 1, 2014.

You must provide project-by-project information that enables the CRA to decide whether each project qualifies.

The CRA requires you to file the information for only the 20 largest projects in dollar value, but can request it for smaller projects later.

The project description must be brief, contain the technical facts and use technical language. It must explain the technological obstacles faced, the technological advances sought or made to your existing technology that enabled you to achieve your objectives, and the iterative experimental work performed.

You should prepare files with the supporting documentation for project costs and experimental work. This facilitates any CRA audit or review. It is easier to have organized documentation at the time the claims are being prepared than to pull it together during a tax audit – possibly long after you file the claim.

CONCLUDING COMMENTS

■ For many greenhouse operators with limited cash flow, investing in SR&ED can be difficult. However, the advancements that result can often be the difference between profitability and stagnation or failure. If qualifying costs have already been incurred, the tax incentives could be significant.

You might not know it, but your operations might already be performing SR&ED. Sometimes the green in your greenhouse could be the tax benefits from SR&ED. ■

|

|

|

Brad McDougall is an incorporated tax partner in the Fraser Valley office of PwC. • 604-495-8955 or brad.j.mcdougall@ca.pwc.com

Micheline Tarazi is a senior manager of SR&ED tax services in the Vancouver office of PwC. • 604-806-7040, micheline.tarazi@ca.pwc.com

Print this page